March 23, 2023

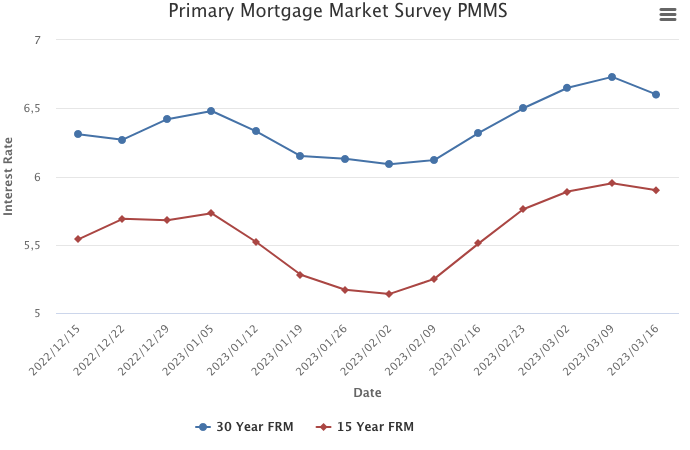

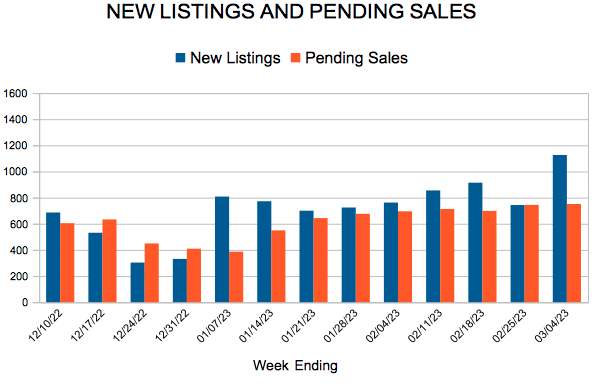

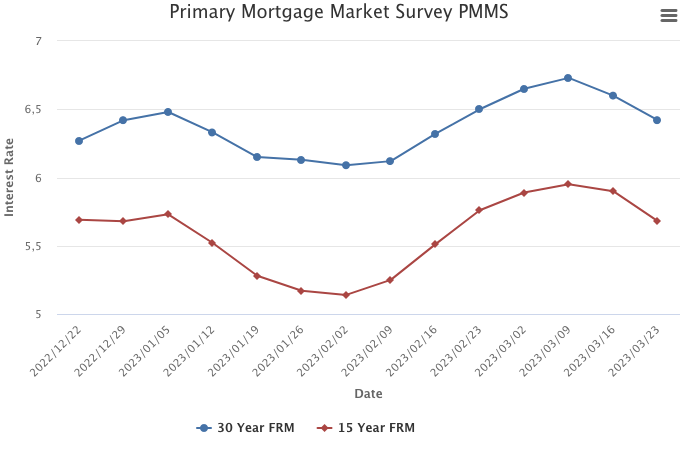

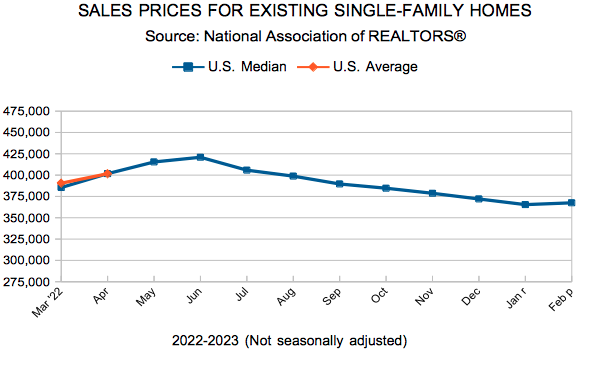

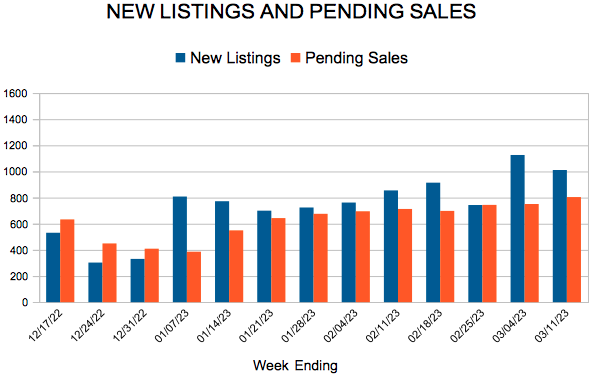

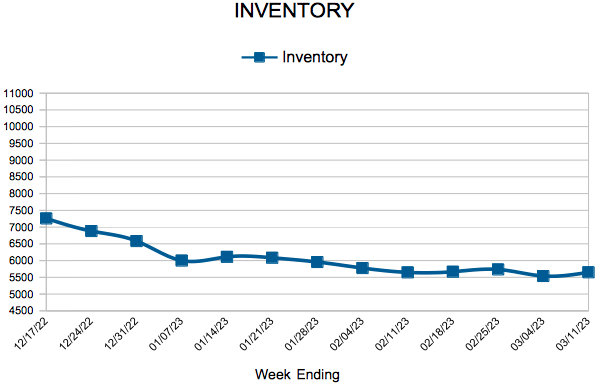

Mortgage rates continued to slide down as financial market concerns came to the fore over the last two weeks. However, on the homebuyer front, the news is more positive with improved purchase demand and stabilizing home prices. If mortgage rates continue to slide over the next few weeks, look for a continued rebound during the first weeks of the spring homebuying season.

Information provided by Freddie Mac.

For Week Ending March 11, 2023

For Week Ending March 11, 2023